Any cryptocurrency received to your wallet from mining activity is taxed as income. If you run a crypto mining trade or business that generates trade or business income involves the owning or leasing of mining equipment and generates over 400 in mining income you are a business miner and have to report mining income as self employment income.

Irs Guidance On Cryptocurrency Mining Taxes Taxbit Blog

For example if you are a consultant and one of your clients paid you for services in cryptocurrency then that income is taxed as self-employment income on your tax return.

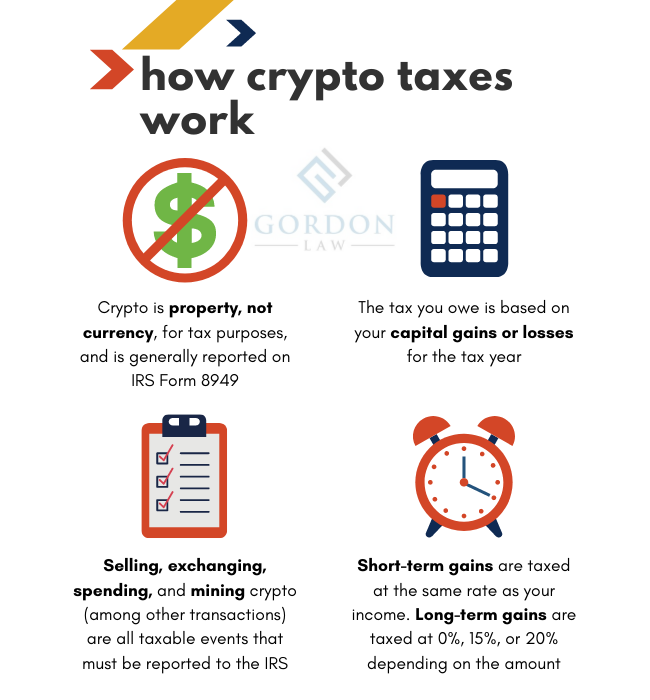

Crypto mining taxes usa. In the US cryptocurrencies like bitcoin are treated as property for tax purposes. Long-term capital gains. Yes crypto miners have to pay taxes on the fair market value of the mined coins at the time of receipt.

This would also create a capital gain of 5000 15000 10000. Staking is in many ways similar to cryptocurrency mining even though the way in which new coins are created is different. Lawmakers in the USA have asked for caution about executing a proposed tax obligation policy that could have considerable implications for Americas crypto area.

The American lawmakers proposed new cryptocurrency taxation that would raise nearly 28 billion in extra tax revenue. The taxpayer must also identify whether they are a hobby or self-employed business miner for tax reporting purposes. The fair market value of the coins at the time you received them the same day should be used as the basis for your taxable income for both business and hobby mining.

In 2020 his total income subject to taxes would be 21000 16000 5000. Last Updated Jul 29 2021 1423 US Senators intend to add 28 billion from cryptocurrency taxes to offset their infrastructure plan. Just like other forms of property like stocks bonds and real-estate you incur capital gains and capital losses on your cryptocurrency investments when you sell trade or otherwise dispose of your crypto.

Do crypto miners have to pay taxes. Any gains or losses made from a crypto asset held for longer than a year incurs a much lower 0 15 or 20 tax depending on. The IRS has not issued specific guidance for the tax treatment of cryptocurrency received from staking so the best we can do is assume the same tax treatment as for mining.

Buying and selling crypto is taxable because the IRS identifies crypto as property not currency. Lets say you have received ethereum ETH to your wallet on different days. As a result tax rules that apply to property but not real estate tax rules transactions like selling collectible coins or vintage cars that can appreciate in value also apply to bitcoin ethereum and other cryptocurrencies.

How crypto mining income is taxed Assume he sells the 1 BTC received on January 1 2020 for 15000 in March 2020. This means that any coins or tokens received as staking rewards should be taxed. In general all income or rewards received by a taxpayer in excess of 400 generated from the mining of cryptocurrency must be reported to the IRS.

Business miners are also subject to the 153 self employment tax. If you receive cryptocurrency as income that crypto is reportable as ordinary income and taxed as income. Mined cryptocurrency is taxed as income with rates that vary between 10 - 37.

Specific members of Congress want assurance that Bitcoin miners as well as crypto software application designers will not go through the recently suggested tax guidelines.

How To Report Taxes On Cryptocurrency Mining Coinpanda

What Is Bitcoin Mining And Is It Profitable Ig En

How To Pay Taxes On Bitcoin For Trading And Mining Freewallet

Cryptocurrency Tax Tips Until Tax Relief Passes Expert Blog Cryptocurrency Cryptocurrency News Tax Office

Crypto And Bitcoin Taxes Guide 2021 Cryptocurrencies Regulations And Taxation Worldwide

Usa Is Banning Bitcoin Mining And Ethereum Crypto Staking Youtube

Cryptocurrency And Taxes Guide 2020 Coincasso Exchange

Your Crypto Tax Questions Answered Lexology

Chinese Miners Bring 3 000kg Mining Hardware To The United States

Discover Why The Gold Rate In Usa Is Skyrocketing Best Cryptocurrency Bitcoin Cryptocurrency Trading

Sec Bitcoin Cryptocurrency Exchange Usa Bitcoin Mining Block Amazon Gift Card To Bitcoin Buy Bitcoin Cash India Bitcoin Cryptocurrency Cryptocurrency Bitcoin

Cryptocurrency Taxation How To Take A Step Forward Inter American Center Of Tax Administrations

.png)

The Beginner S Guide To Crypto Mining And Staking Taxes Cryptotrader Tax

Top Countries With Zero Or Low Taxes For Crypto Traders By Crypto Rand Crypto Rand S Newsletter

Here S Why Cryptocurrency Mining Stocks Need Your Attention

What Are 2020 2021 Cryptocurrency Taxes Forbes Advisor

How To Report Cryptocurrency On Taxes Tokentax

:max_bytes(150000):strip_icc()/GettyImages-959997240-593e261ff24a4908a94ac280c33dfbe1.jpg)