The April 17th tax deadline is approaching and miners are no exception. However miners may be able to leverage bonus depreciation methods and Section 179 expensing to increase deductions and accelerate those tax savings.

How And When To Write Off Crypto Bitcoin Mining Expenses Youtube

In the Internal Revenue Services IRS eyes Bitcoin and cryptocurrency miners have two taxation obligations to consider.

Crypto mining tax deductions. The deduction of the Trading Allowance cannot create a loss. Cryptocurrency Mining as a Business. However in most cases a.

This means you will owe crypto mining taxes on its value at the time it is earned regardless of any gains or losses to its value during the rest of the tax year. In this case you would write off your expenses on Schedule A and would only benefit if your expenses included with other expenses you itemize are greater than the standard deduction. Using the Accelerated Cost Recovery depreciation methods recognized by the IRS coin miners typically deduct the value of their rigs over a span of three to five years.

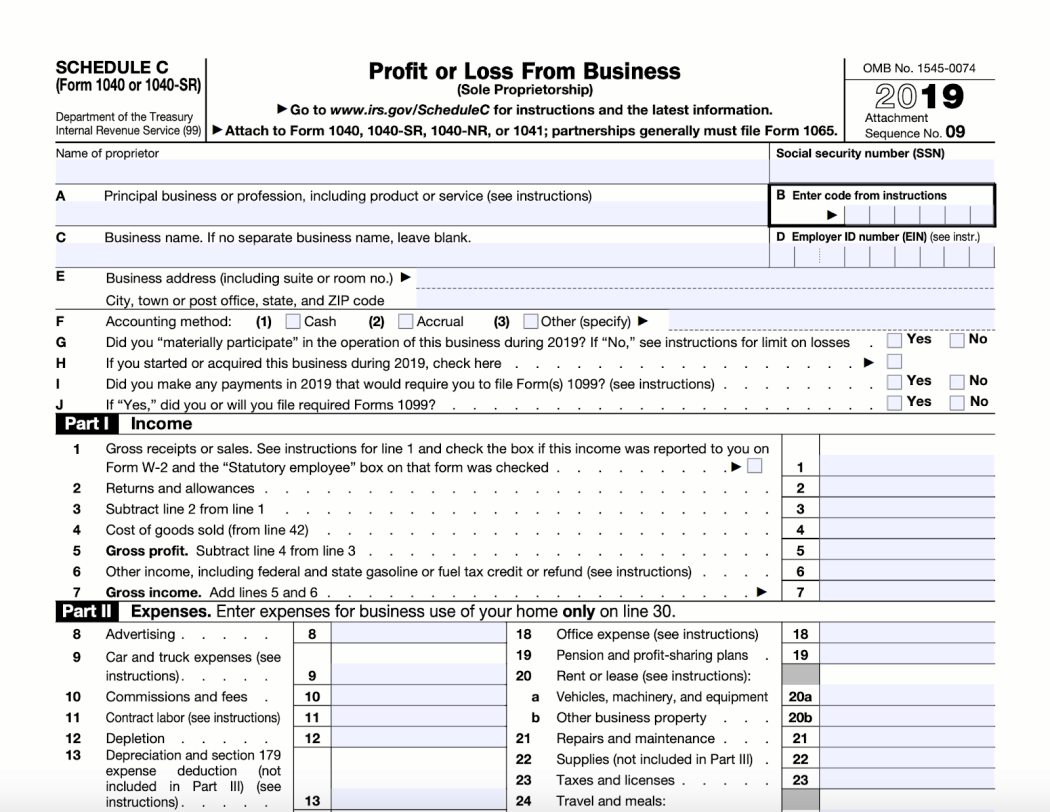

To report business income from mining the taxpayer will report. Those engaging in mining activities on a business scale can claim deduction on expenses. Expenses related to the mining business activity including but not limited to the depreciation of mining equipment electricity and hardware may be deducted for tax purposes.

This article dispels some of the confusion surrounding cryptocurrency mining and taxes. If the IRS sees your mining activity as a hobby you still may be able to deduct some expenses but only if they exceed 2 of your gross income. Hence unless your mining deductions are larger than this it.

For example if the income is 600 you cannot deduct the. Crypto mining expenses should be deducted on Schedule A as itemized deductions. Proof of Stake Mining Tax Ramifications.

Yes there are crypto mining deductions available when mining is classified as a business not a hobby. Your net income roughly income less deductions is the amount that is included in your assessable income and you will pay tax on this income at your marginal rate. Cryptocurrency miners also need to consider filing capital gains taxes after selling their coins.

Crypto Mining Costs and Your Taxes Since you incur costs such as electricity and the cost of hardware when mining cryptocurrencies you might be wondering if these costs are deductible on your taxes. Some frequent expenses that may be eligible for the trade or business expense deduction include. How the IRS treats you however depends on whether you mine cryptocurrency as a hobby or a business.

Yes bitcoin and other crypto mining are taxed as regular income. Here are some of the measures that the IRS provides for determining which camp you are in. The Trading Allowance cannot be claimed against the cryptoasset mining income if self-employed expenses are being deducted from any self-employed income.

Business miners are also subject to self-employment tax at a rate of 153 for the 2017 and 2018 tax year. 1 their mining revenue as a source of income and 2 any capital gains they capture from selling their mined coins for USD. This is not that great because these deductions give in many cases very little tax benefits for most hobby miners.

The quick answer is Yes you can deduct your cryptocurrency related expenses. A taxable event is triggered when earned cryptocurrency is deposited into your wallet. This upcoming tax season the standard deduction is 6500 for singles and 13000 for married couples.

If your mining is a hobby then any deductions are reported on Schedule A as itemized deductions. In the US the IRS allows for a standard deduction of 6350 per person or 12700 for a family as per 2017 tax year. Equipment used in mining crypto should be capitalized and depreciated like any other property whose useful life extends beyond one year.

Crypto mining rewards are seen as ordinary income for tax purposes and are taxable at receipt not when funds are sold. The manner in which the taxpayer carries on. Like with any other industry Uncle Sam wants a piece of your Bitcoin mining revenue but how exactly are miners supposed to report their taxes.

Losses you make from a business of Bitcoin mining will be deductible against your other income however losses you make will be subject to the Non-commercial loss provisions. To mention a few of the limitations you are only allowed to deduct expenses exceeding 2 of your total gross income and it doesnt allow expenses for start-up costs or home office. And rented space used to operate the equipment.

The way cryptocurrency mining income is taxed depends on whether you are a hobbyist miner or a self-employed business miner.

Making The Most Of Crypto Mining Tax Breaks Sxi Io

Crypto Mining Tax How To Report Your Income Correctly Pop Business

The Most Crypto Friendly Tax Countries Wanderers Wealth

What You Need To Know About Crypto Mining Tax Tokentax

Taxes On Mining Income Blockpit Cryptotax

A Guide To Cryptocurrency Mining Taxes Fullstack Advisory

South Korea To Tax Crypto Profits 20 Mining Cost Deductible

How To Report Taxes On Cryptocurrency Mining Coinpanda

Irs Guidance On Cryptocurrency Mining Taxes Taxbit Blog

Ethereum Vs Digibyte Can You Deduct Coin Mining Equipment Cost From Taxes Clinvacin

Tax Reductions Can Be Received For Expenses During Mining In South Korea

Your Crypto Tax Questions Answered Lexology

Cryptocurrency Tax Calculator Rig Name Ethereum Mining Evident Consulting Economic

The Beginner S Guide To Crypto Mining And Staking Taxes Cryptotrader Tax

.png)

The Beginner S Guide To Crypto Mining And Staking Taxes Cryptotrader Tax

The Beginner S Guide To Crypto Mining And Staking Taxes Cryptotrader Tax

Can I Deduct Bitcoin Mining Costs Bitcoin Mining Expenses

Kikmoney Earn Free Bitcoin Usd New Mining Site Earn Daily 50 Urdu Mining Site Bitcoin Free Bitcoin