The ruling responded to a taxpayer inquiry asking whether a bitcoin miner should include the value of mined bitcoin in income at the time. As a miner carrying on a business any bitcoin that you acquire from mining is treated as trading stock.

Proto Bitcoin Mining Rig Early Burn In Testing Bitcoin Mining Rigs Bitcoin Mining Hardware Bitcoin

General tax principles applicable to property transactions apply to transactions using virtual currency.

Mining bitcoin tax treatment. HMRC has now published a second paper about the tax treatment of cryptoasset transactions involving businesses and companies. The Canadian Tax TreaTmenT OF BiTCOin 113 bitcoin may satisfy either definition. Tax Treatment Of Cryptocurrency Mining.

Basis based generally on. Separate to simply buying and holding bitcoins or trading bitcoins ATO has a separate tax treatment for individuals who mine bitcoin. 1 Direct tax treatment of cryptocurrencies The direct taxes are corporation tax income tax and capital gains tax.

The tax treatments outlined in this manual are for tax purposes only. 3 Both gold and cryptoassets share many characteristics with the process of creation and distribution of new. In the third part of the paper we review a number of income tax issues related to bitcoin including the potential application of rules pertaining to borrowed money foreign currency and barter.

Mined cryptocurrency is taxed as income with rates that vary between 10 - 37. The income tax treatment of the mining of gold and its use fall under specific Code provisions and general tax principles. As in any other business proceeds from the disposal of trading stock represent assessable income.

For federal tax purposes virtual currency is treated as property. If you acquired a bitcoin or part of one from mining that value is taxable immediately. Cryptocurrency generally operates independently of a central bank central authority or government.

As cryptoassets such as bitcoin have gained status as virtual assets commentators have suggested that they serve as the new virtual gold. Similar to other forms of property stocks bonds real-estate you incur capital gains and capital losses when you sell trade or otherwise dispose of your bitcoin. It is known as Notice 2014-21 Q-9 and it relates how the IRS applies existing tax code to the treatment of virtual currencies including mining Bitcoin and other cryptocurrencies.

Yes crypto miners have to pay taxes on the fair market value of the mined coins at the time of receipt. The CRA stated that Bitcoin mining should be treated as a barter transaction which it defines as being effected when any two persons agree to a reciprocal exchange of goods or services and carry out that exchange usually without using money. This is decided case by case.

They do not reflect on the treatment of cryptocurrencies for regulatory or other purposes. When received fair market value FMV at time of receipt determines income or amount realized. Tax treatment of cryptocurrencies.

The income tax treatment for cryptocurrency miners is different depending on whether their mining activities are a personal activity a hobby or a business activity. The tax treatment depends on the market value at the time of the transaction and how long the bitcoins are in circulation. On August 8 2019 the Canada Revenue Agency the CRA released an Income Tax Ruling 2018-0776661I7 clarifying its view on the taxation of cryptocurrency miners.

Miners who work for themselves have net earnings from self-employment treated as self-employment income and subject to self-employment tax Notice 2014. According to the document Bitcoin and other cryptocurrencies obtained through mining can generally be considered self-employment income so long as the mining is not done by an individual in the capacity as an employee. No need to sell the currency to create a tax liability.

ATO treats miners as if they are running their own business and bitcoins are treated in the same manner as trading stock. For more information see Applying the 20000 instant asset write-off or Deductions on our website. The IRS classifies mining income as self-employment income and taxpayers may be responsible for self-employment taxes on mined income.

Cryptocurrency mining is typically taxed. The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain. A hobby is generally undertaken for pleasure entertainment or enjoyment rather than for business reasons.

The IRS treats bitcoin and other cryptocurrencies as property for tax purposes.

.png)

The Beginner S Guide To Crypto Mining And Staking Taxes Cryptotrader Tax

Virtual Currencies The Future Of Payments Currency Bitcoins Finance Advanced Mining Technologies Inc Virtual Currency Cryptocurrency Bitcoin Cryptocurrency

Irs Guidance On Cryptocurrency Mining Taxes Taxbit Blog

Bitcoin Wallpaper 2560x1600 What Is Bitcoin Mining Bitcoin Mining Virtual Currency

Cryptocurrency That Is Bitcoin How Irs Treats Virtual Currency

Taxation Of Cryptocurrency Liquidity Mining Yield Farming

Mining Bitcoin Google Search What Is Bitcoin Mining Bitcoin Mining Bitcoin

Income Tax Implications Of Transactions In Crypto Currency

How To Report Taxes On Cryptocurrency Mining Coinpanda

How Developed Countries Collect Taxes On Bitcoin

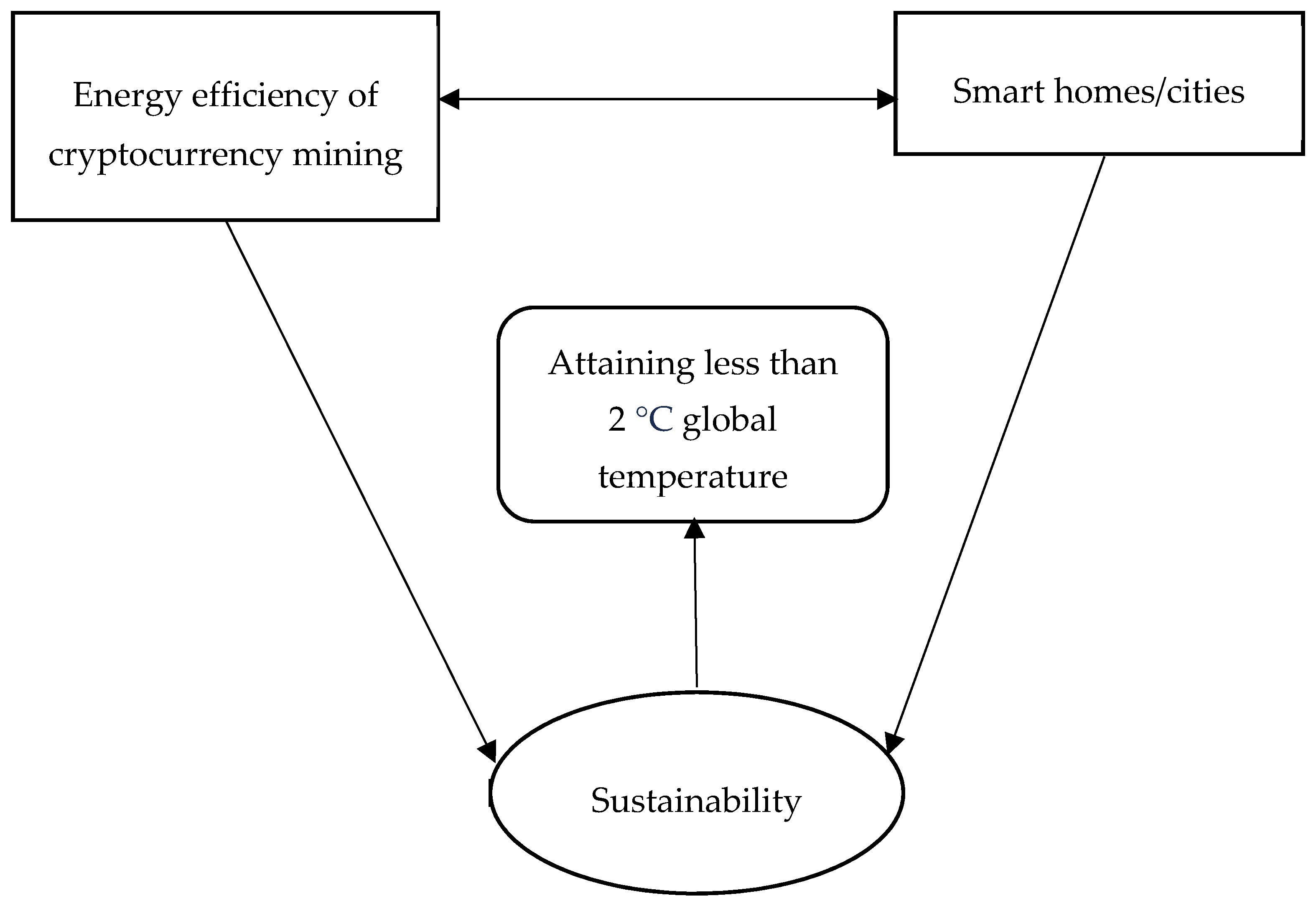

Sustainability Free Full Text Opinions On Sustainability Of Smart Cities In The Context Of Energy Challenges Posed By Cryptocurrency Mining Html

Find It Hard To Understand Bitcoin Here Is Everything You Need To Know Btc Wonder Bitcoin Bitcoin Transaction Cryptocurrency

Airdrops And Hard Forks Tax Theory On Crypto Currency Distributions

Cryptocurrency Taxation How To Take A Step Forward Inter American Center Of Tax Administrations

Should I Start An Llc For My Bitcoin Mining Business

Infographic Bitcoin Versus Gold What Is Bitcoin Mining Bitcoin Bitcoin Mining