If your cryptocurrency was stolen and classifies as a theft loss its unlikely that you can write this off. Crypto mining staking hard forks and interest income.

Invest In Crypto Cryptocurrency Blockchain Cryptocurrency Investing

Even though it might have been possible to legally not pay taxes on crypto mining in the past anyone making profits off of cryptocurrency mining in 2018 Tax Year 2019 and beyond will now be subject to taxation.

Crypto mining tax write off. Either way you can write off expenses but as noted below the amount you can write off varies depending on how the IRS classifies your activity. If you are doing crypto mining in a more professional manner and the activity is classified as a business you need to report the taxable income on Schedule C Profit or Loss from Business. Yes bitcoin and other crypto mining are taxed as regular income.

Losses you make from a business of Bitcoin mining will be deductible against your other income however losses you make will be subject to the Non-commercial loss provisions. Selling crypto swapping crypto. Senator Mike Lee has raised concerns that adopting the crypto tax provision in the 12 trillion infrastructure bill will stifle innovation and make Americans poorer.

The short answer is it depends if their activity is classified as a hobby or a business. This means you will owe crypto mining taxes on its value at the time it is earned regardless of any gains or losses to its value during the rest of the tax year. US Mining Tax Laws.

Buying crypto donating coin swaps. A taxable event is triggered when earned cryptocurrency is deposited into your wallet. If your crypto tax loss puts you below the 38700 mark youd only have to pay 95250 plus 12 of any amount over 9525.

Mined cryptocurrency is taxed as income with rates that vary between 10 - 37. If you dabbled in the crypto market in 2020-2021 then you will likely pay one or both of these taxes. You are also allowed to fully deduct any expenses associated with the mining activity to offset your mining.

Your net income roughly income less deductions is the amount that is included in your assessable income and you will pay tax on this income at your marginal rate. Can I write off the loses in my portfolio. Similar to casualty losses above post-2017 after the Tax Cuts and Jobs Act was passed theft losses are no longer deductible on Form 4684.

Watch Warren Kritko of Crypto University and the Crypto Tax Fixer of CryptoTaxAudit on Facebook talking taxes and diving into what is considered a taxable event in crypto. Heres a look at the 2018 tax brackets for single individuals. Even though it might have been possible to legally not pay taxes on crypto mining in the past anyone making profits off of cryptocurrency mining in 2018 Tax Year 2019 and beyond will now be subject to taxation.

In most countries where crypto is taxed three types of tax rules apply. Regardless if you are mining as a small side-hustlehobby or a full-time business there are new rules which the. He explained that cryptocurrencies are not like securities and cannot be regulated with the same policies noting that to do so would drive innovation offshore.

Is crypto mining taxed. But if you made 38701 or more youd have to pay over four times as much in taxes plus 22 of any amount over 38700. Regardless if you are mining as a small side-hustlehobby or a full-time business there are new rules which the US Congress passed.

Cryptocurrency Mining as a Hobby. Yes crypto miners have to pay taxes on the fair market value of the mined coins at the time of receipt. Common cryptocurrency theft losses include the following.

Do crypto miners have to pay taxes. Clients who mine cryptocurrencies often ask me what they are able to write off.

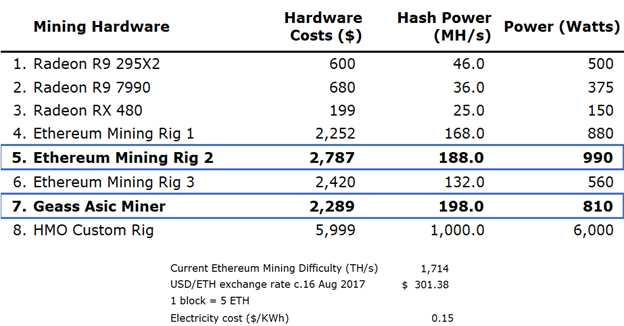

Crypto Mining 101 Calculating Profitability By Ethan London Blockchain Labs Medium

Should I Start An Llc For My Bitcoin Mining Business

Parallel Miner Breakout Board Video Card Parallel

Irs Guidance On Cryptocurrency Mining Taxes Taxbit Blog

Iranian Police Arrest Smuggler Confiscate 300k Worth Of Crypto Mining Hardware Cryptopolitan

Bitcoin Graph Chart Bitcoin Earn Bitcoin Fast Futures Contract

:max_bytes(150000):strip_icc()/BlockReward-5c0ad88946e0fb0001af7198.png)

Bitcoin Mining Definition Is It Still Profitable

Tax Rules For Bitcoin Are Based On How It S Being Used As An Investment Capital Gains Mining Staking Investing Investment Advisor Investment Accounts

A Guide To Cryptocurrency Mining Taxes Fullstack Advisory

Crypto City Meet The Owner And Director Of Liverpool S First Crypto Mining Company Visitliverpool

50m Of Eth Stolen Rare Opportunity For Btc Hodlers Digest Nov 25 Dec 1 Blockchain World News Video Bitcoin Business

Can I Deduct Bitcoin Mining Costs Bitcoin Mining Expenses

:max_bytes(150000):strip_icc()/dotdash_Final_How_Does_Bitcoin_Mining_Work_Dec_2020-01-bd91c1773e5d4320b9b0e3cee1ecc4fd.jpg)

How Does Bitcoin Mining Work What Is Crypto Mining

.png)

The Beginner S Guide To Crypto Mining And Staking Taxes Cryptotrader Tax

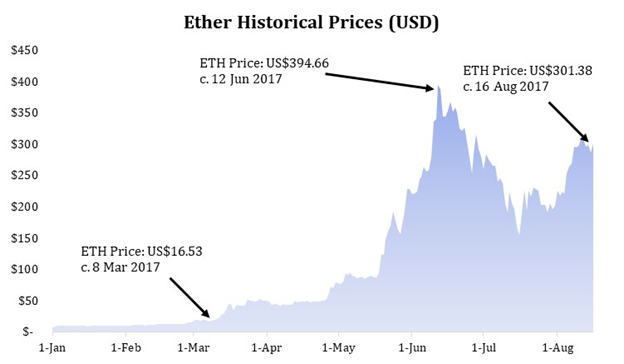

Ethereum Mining Is Profitable But Not For Long

Ethereum Mining Is Profitable But Not For Long

Bitcoin Mining Explained Bitcoin Mining Bitcoin Bitcoin Mining Software