This is decided case by case. In the US cryptocurrencies like bitcoin are treated as property for tax purposes.

The Beginner S Guide To Crypto Mining And Staking Taxes Cryptotrader Tax

Cryptocurrency mining incurs GST compliance obligations.

Crypto mining business tax. Denmark- In the future cryptocurrency companies will be taxed. Mined cryptocurrency is taxed as income with rates that vary between 10 - 37. In the Internal Revenue Services IRS eyes Bitcoin and cryptocurrency miners have two taxation obligations to consider.

Profits generated through mining is 100 assessable are calculated utilising the trading stock rules. The income tax treatment for cryptocurrency miners is different depending on whether their mining activities are a personal activity a hobby or a business activity. Equipment costs operational costs and losses are tax deductible.

In this case losses may be able to offset other income. A hobby is generally undertaken for pleasure entertainment or enjoyment rather than for business. Losses you make from a business of Bitcoin mining will be deductible against your other income however losses you make will be subject to the Non-commercial loss provisions.

Private individuals wont be taxed. Tax implications of cryptocurrency mining Mining digital currency creates numerous tax implications that a user must report on multiple forms. The sale of coins generated through mining is defined as business income.

Your net income roughly income less deductions is the amount that is included in your assessable income and you will pay tax on this income at your marginal rate. Yes crypto miners have to pay taxes on the fair market value of the mined coins at the time of receipt. Whether you are a business with a custom mining rig or you mine on a computer as a personal investment.

Commercial mining tax implications. The hardware and electricity expenses of a mining rig combined with a volatile crypto market mean that it is possible for a mining business to lose money over the course of a tax year. Go to answer.

1 their mining revenue as a source of income and 2 any capital gains they capture from selling their mined coins for USD. 1000 in electricity Pretty sure taxable amount is 9000 10000 recorded as closing stock. Germany- There are no taxes if crypto is held as an asset for greater than one year.

Person as compensation for services are all included in a taxpayers gross income. The Internal Revenue Service IRS has published some guidance on virtual currency via Notice 2014. Belarus- Crypto tax breaks will officially last until at least 2023.

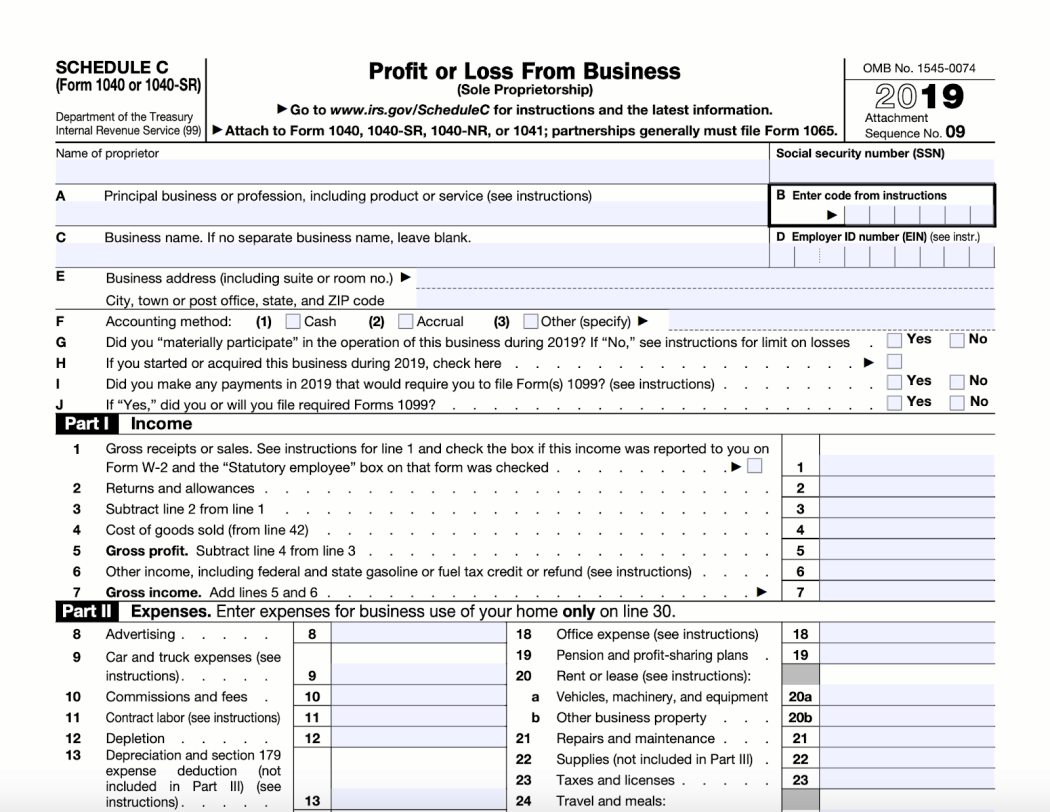

Just like other forms of property like stocks bonds and real-estate you incur capital gains and capital losses on your cryptocurrency investments when you sell trade or otherwise dispose of your crypto. Do crypto miners have to pay taxes. Mining as a Business If you are doing crypto mining in a more professional manner and the activity is classified as a business you need to report the taxable income on Schedule C Profit or Loss from Business.

This 9000 will form apart of. Less 1000 in deduciton will leave net buisness income as 9000. 10000 in bitcoin from mining.

Therefore all gains and losses from trading crypto crypto earned from mining operations which includes both PoS and PoW protocols and crypto paid to a US. This means that all income derived from mining including from the transfer of the mined bitcoin to another party or the disposal of such coins would be part of your assessable income. Any income derived from mining cryptocurrency as a business then your tax liability will be treated in the same way as other businesses.

You are also allowed to fully deduct any expenses associated with the mining activity to offset your mining income.

Bitcoin Mining Explained Bitcoin Mining Bitcoin Bitcoin Mining Software

What You Need To Know About Crypto Mining Tax Tokentax

Irs Guidance On Cryptocurrency Mining Taxes Taxbit Blog

![]()

7 Faqs On Cryptocurrencies Crypto Tax In Austria Tpa Tax Advisory

Income Tax Implications Of Transactions In Crypto Currency

Citizenship By Investment For Cryptocurrency Investors Best Citizenships

Is Serbia A Great Place For Crypto Mining Chainvest

Free Bitcoin Cloud Mining Bitcoin Cloud Mining 2020 Legit Bitcoin News Aggregator Bitcoin Today News Cloud Mining Bitcoin Free Bitcoin Mining

The Beginner S Guide To Crypto Mining And Staking Taxes Cryptotrader Tax

Cryptocurrency In Indonesia Coinmarketcap

How To Report Taxes On Cryptocurrency Mining Coinpanda

.png)

The Beginner S Guide To Crypto Mining And Staking Taxes Cryptotrader Tax

A Guide To Cryptocurrency Mining Taxes Fullstack Advisory

Taxes On Cryptocurrency In Spain How Much When How To Pay

Bitcoin Gold Is A Hard Fork Of Bitcoin That Allows You To Mine With Gpu Btg Implements A New Pow Algorithm That M Bitcoin Bitcoin Mining Pool Startup Company

Should I Start An Llc For My Bitcoin Mining Business

Uk Cryptocurrency Tax Guide Cointracker