A taxable event is triggered when earned cryptocurrency is deposited into your wallet. Similar to casualty losses above post-2017 after the Tax Cuts and Jobs Act was passed theft losses are no longer deductible on Form 4684.

Crypto City Meet The Owner And Director Of Liverpool S First Crypto Mining Company Visitliverpool

Buying crypto donating coin swaps.

Crypto mining tax write off. You are also allowed to fully deduct any expenses associated with the mining activity to offset your mining. Even though it might have been possible to legally not pay taxes on crypto mining in the past anyone making profits off of cryptocurrency mining in 2018 Tax Year 2019 and beyond will now be subject to taxation. Selling crypto swapping crypto.

Crypto mining staking hard forks and interest income. But if you made 38701 or more youd have to pay over four times as much in taxes plus 22 of any amount over 38700. Your net income roughly income less deductions is the amount that is included in your assessable income and you will pay tax on this income at your marginal rate.

If your crypto tax loss puts you below the 38700 mark youd only have to pay 95250 plus 12 of any amount over 9525. Do crypto miners have to pay taxes. If you are doing crypto mining in a more professional manner and the activity is classified as a business you need to report the taxable income on Schedule C Profit or Loss from Business.

Can I write off the loses in my portfolio. Mined cryptocurrency is taxed as income with rates that vary between 10 - 37. Cryptocurrency Mining as a Hobby.

Clients who mine cryptocurrencies often ask me what they are able to write off. Watch Warren Kritko of Crypto University and the Crypto Tax Fixer of CryptoTaxAudit on Facebook talking taxes and diving into what is considered a taxable event in crypto. Is crypto mining taxed.

This means you will owe crypto mining taxes on its value at the time it is earned regardless of any gains or losses to its value during the rest of the tax year. If you dabbled in the crypto market in 2020-2021 then you will likely pay one or both of these taxes. Senator Mike Lee has raised concerns that adopting the crypto tax provision in the 12 trillion infrastructure bill will stifle innovation and make Americans poorer.

Regardless if you are mining as a small side-hustlehobby or a full-time business there are new rules which the US Congress passed. In most countries where crypto is taxed three types of tax rules apply. Yes crypto miners have to pay taxes on the fair market value of the mined coins at the time of receipt.

If your cryptocurrency was stolen and classifies as a theft loss its unlikely that you can write this off. Regardless if you are mining as a small side-hustlehobby or a full-time business there are new rules which the. Heres a look at the 2018 tax brackets for single individuals.

Yes bitcoin and other crypto mining are taxed as regular income. US Mining Tax Laws. He explained that cryptocurrencies are not like securities and cannot be regulated with the same policies noting that to do so would drive innovation offshore.

The short answer is it depends if their activity is classified as a hobby or a business. Even though it might have been possible to legally not pay taxes on crypto mining in the past anyone making profits off of cryptocurrency mining in 2018 Tax Year 2019 and beyond will now be subject to taxation. Either way you can write off expenses but as noted below the amount you can write off varies depending on how the IRS classifies your activity.

Common cryptocurrency theft losses include the following. Losses you make from a business of Bitcoin mining will be deductible against your other income however losses you make will be subject to the Non-commercial loss provisions.

Iranian Police Arrest Smuggler Confiscate 300k Worth Of Crypto Mining Hardware Cryptopolitan

A Guide To Cryptocurrency Mining Taxes Fullstack Advisory

Tax Rules For Bitcoin Are Based On How It S Being Used As An Investment Capital Gains Mining Staking Investing Investment Advisor Investment Accounts

Should I Start An Llc For My Bitcoin Mining Business

Bitcoin Mining Explained Bitcoin Mining Bitcoin Bitcoin Mining Software

Can I Deduct Bitcoin Mining Costs Bitcoin Mining Expenses

Bitcoin Graph Chart Bitcoin Earn Bitcoin Fast Futures Contract

50m Of Eth Stolen Rare Opportunity For Btc Hodlers Digest Nov 25 Dec 1 Blockchain World News Video Bitcoin Business

:max_bytes(150000):strip_icc()/dotdash_Final_How_Does_Bitcoin_Mining_Work_Dec_2020-01-bd91c1773e5d4320b9b0e3cee1ecc4fd.jpg)

How Does Bitcoin Mining Work What Is Crypto Mining

Ethereum Mining Is Profitable But Not For Long

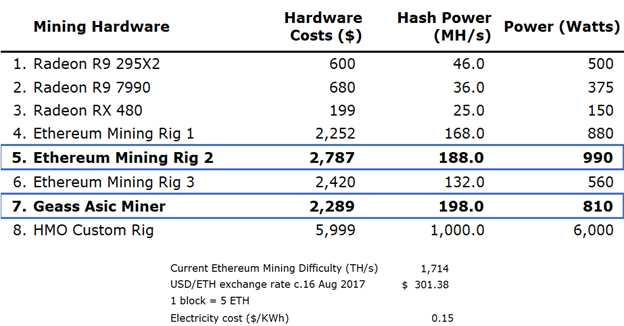

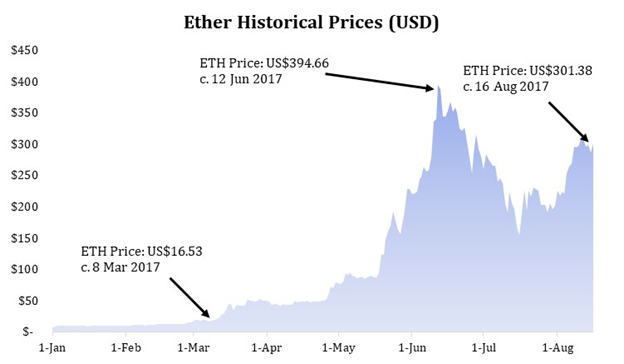

Crypto Mining 101 Calculating Profitability By Ethan London Blockchain Labs Medium

.png)

The Beginner S Guide To Crypto Mining And Staking Taxes Cryptotrader Tax

:max_bytes(150000):strip_icc()/BlockReward-5c0ad88946e0fb0001af7198.png)

Bitcoin Mining Definition Is It Still Profitable

Irs Guidance On Cryptocurrency Mining Taxes Taxbit Blog

Parallel Miner Breakout Board Video Card Parallel

Invest In Crypto Cryptocurrency Blockchain Cryptocurrency Investing

Ethereum Mining Is Profitable But Not For Long