The new law makes it appealing for Bitcoin miners to set up shop in the state as electricity bills are. They have a free utility where you import your numbers from pholonix Coinbase Nicehash wallet address etc and it outputs a form that you input into turbo tax.

Advertising Online Business What I Found When I Checked Out Infinity Traffic B Internet Business Opportunities Online Business Opportunities Internet Business

Have bitcoin and want to liquidate diversify get a tax deduction enjoy lifetime income and be generous.

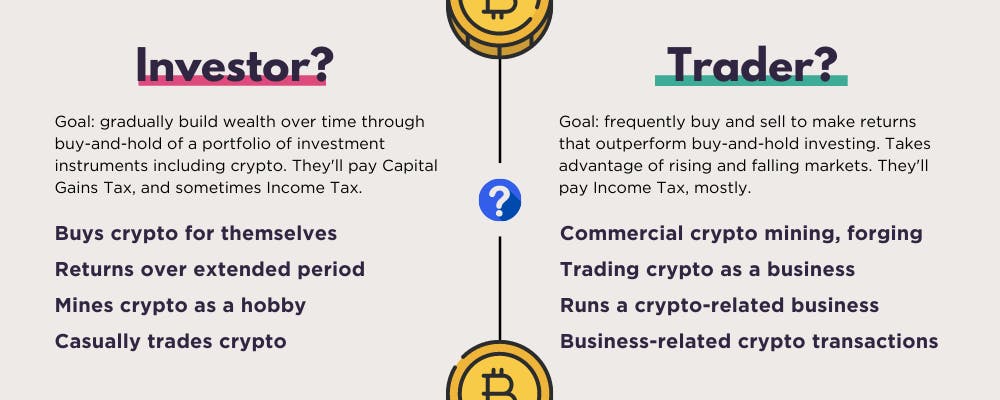

Bitcoin mining tax deduction. Shows I owe 33 bucks in tax from my mining rig. If you mine cryptocurrency as a trade or business not a hobby then you may be eligible for certain deductions to lessen your tax liability. 3 Both gold and cryptoassets share many characteristics with the process of creation and distribution of new cryptoassets becoming known as virtual mining.

Mr A is a Bitcoin miner. Your net income roughly income less deductions is the amount that is included in your assessable income and you will pay tax on this income at your marginal rate. Miners may deduct certain expenses from their mining incomeThe cost of computers service and electricity used to mine bitcoin can be deducted against your mining income.

Losses you make from a business of Bitcoin mining will be deductible against your other income however losses you make will be subject to the Non-commercial loss provisions. Here is an example from the ICAEW concerning cryptoasset mining income. Losses you make from a business of Bitcoin mining will be deductible against your other income however losses you make will be subject to the Non-commercial loss provisions.

If youre mining as a business and earning income from it you can deduct your ongoing costs eg repairsmaintenance for the mining machines electricity bills lowering your tax obligations. As cryptoassets such as bitcoin have gained status as virtual assets commentators have suggested that they serve as the new virtual gold. Blockware Mining reported plans to create 10 jobs with an average hourly wage of 23 including employee benefits.

You can deduct the cost of Bitcoin mining equipment though not 100 percent to reduce your taxes. The answer may be a charitable remainder trust. How to report Bitcoin mining income on your crypto taxes.

The income tax treatment of the mining of gold and its use fall under specific Code provisions and general tax principles. Cryptocurrency Mining as a Business. That comes under the Section 179 deduction.

If you register your Bitcoin mining operation as a business you will be able to deduct more expenses than if it is categorized as a hobby. For example if the income is 600 you cannot deduct the 1000 Trading Allowance and claim a loss of 400. In this case you would write off your expenses on Schedule A and would only benefit if your expenses included with other expenses you itemize are greater than the standard deduction.

You can use the cost of Bitcoin mining equipment for instance to offset some of the tax due on your Bitcoin mining profits. No such deduction is allowed if you are mining as a hobby. The approval means that cryptocurrency miners will be exempt from the usual 6 sales tax on power consumption in the state between July 1 2021 to June 30 2025.

In this example the Trading Allowance is restricted to 600 so that a loss is not created. More recently in January state officials approved tax incentives for Blockware Mining to open a cryptocurrency mining operation in leased space in Paducah with a total investment of 284 million. 162 of the Internal Revenue Code states there shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business.

This upcoming tax season the standard deduction is 6500 for singles and 13000 for married couples. Your net income roughly income less deductions is the amount that is included in your assessable income and you will pay tax on this income at your marginal rate.

Comparing Proof Algorithms Proof Of Work Vs Proof Of Stake Infographic Holytransaction Algorithm Stakes Infographic

Complete Bitcoin Vault Full Presentation Mining City Global Bitcoin Presentation Mining

Australian Cryptocurrency Tax Guide 2021 Koinly

Cara Mining Bitcoin Di Android Termux Buy Bitcoin Bitcoin Cryptocurrency

Why The Rich Get Richer It Only Depends On The Mindset Richpeople Poorpeople If You Want To Support Us Tag Someo How To Get Rich Investing Income Investing

Logan Paul S Cryptocurrency In 2021 Bitcoin Cryptocurrency Bitcoin Cryptocurrency

How To Report Cryptocurrency On Taxes Tokentax

Against Your Qbi For That Year Example This Year George Earned 20 000 In Qbi From His Bitcoin Mining Business And Had A Tax Deductions Business Deduction

Bitcoin Performance Vs Other Currencies Bitcoin Investing Startup Company

Tax Rules For Bitcoin Are Based On How It S Being Used As An Investment Capital Gains Mining Staking Investing Investment Advisor Investment Accounts

10 Tax Filing Mistakes To Avoid Filing Taxes Mistakes Budgeting Finances

Cryptocurrency Investments Investing Cryptocurrency Financial Asset

Motivation Opportunity Moneyman Moneyquotes Cash Surveymoney Dollars Entrepreneur Makemoney Makemoneyathome Online Investing Cryptocurrency Fiat Money

Do You Mine Coins Whether Your Mining Is Active Passive Or Hobby Income Depends On How Much Time And Personal Bitcoin Mining Bitcoin What Is Bitcoin Mining

Kikmoney Earn Free Bitcoin Usd New Mining Site Earn Daily 50 Urdu Mining Site Bitcoin Free Bitcoin